Published

- 6 min read

Stay Ahead of the Market with Behavix's Data-as-a-Service Products

In 2024 and so far in 2025, consumers in the United States have navigated a complex economic landscape marked by persistent inflation, slowing global growth, and geopolitical instability. These factors have influenced purchasing behaviors, financial confidence, and overall market sentiment.

Behavix empowers investors, analysts, and market researchers by providing deep insights into how these economic challenges impact consumer sentiment and spending patterns. Through passively collected digital behavioral data, covering all the key platforms on mobile and desktop devices, from approximately 500.000 US customers, which are part of Behavix opt-in based behavioral data collection ecosystem, Behavix provides a variety of data and insights solutions for clients. Behavix offers a real-time, data-driven understanding of shifting consumer sentiment and preferences, enabling stakeholders to make more informed strategic and investment decisions in a rapidly evolving and unstable market.

Let’s dive into an example using Behavix data to analyze two of the largest US retailers, Walmart and Target. Both companies saw significant online sales growth and strong stock performance during the lockdown period of 2021-2022, as consumers turned to e-commerce for essential goods and discretionary purchases. However, the economic landscape has shifted dramatically since then, with rising inflation, fluctuating consumer confidence, and evolving shopping behaviors reshaping retail dynamics.

To better understand how these factors are currently influencing Walmart and Target’s digital engagement, we’ll focus on Q3 2024. We picked Q3 2024 specifically because the economy was cited as the most important issue for voters for the presidential election in Nov 2024 thereby making this a key quarter to analyze customer sentiment. By examining real-time customer interactions across both their websites and mobile apps, we can gain a clearer picture of how economic conditions are affecting shopper behavior, from browsing patterns to purchase intent.

Behavix continuously collects and processes customer engagement data from both desktop (Windows, macOS, and Linux) and mobile devices (iOS and Android). Using our clickstream and app sessions datafeeds, we’ll analyze how user engagement is growing or declining, and what insights can be unlocked about shifting consumer preferences. This data-driven approach enables investors, analysts, and market researchers to anticipate trends and make informed decisions with a level of timeliness and granularity that traditional reports simply can’t provide.

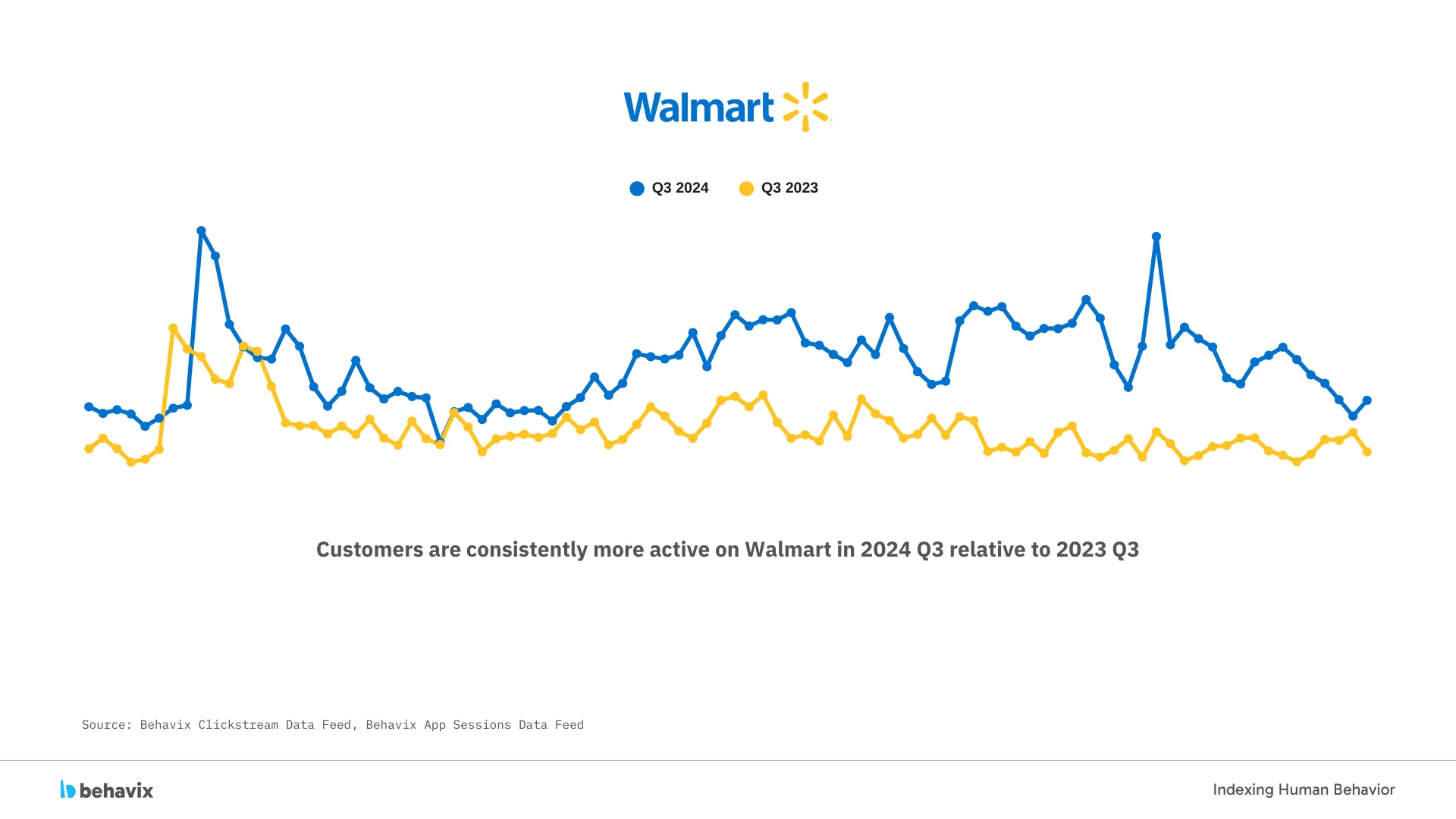

We begin our analysis with Walmart by examining customer visit trends in Q3 2024 compared to Q3 2023. By using the same quarter from the previous year as a benchmark, we account for seasonal variations and ensure a more accurate assessment of YoY changes in consumer behavior.

The visualization below illustrates a clear trend: customer engagement on Walmart’s online retail platform has been consistently higher throughout Q3 2024 compared to the same period in 2023. This suggests a sustained increase in digital shopping activity, potentially driven by factors such as shifting consumer preferences or macroeconomic conditions influencing online spending.

By analyzing behavioral data at this level of granularity, we can uncover deeper insights into what’s driving this engagement—whether it’s an uptick in mobile usage, an increase in repeat visits, or shifts in shopping frequency. These patterns provide valuable signals for understanding Walmart’s digital performance and its broader implications for retail and investor strategies.

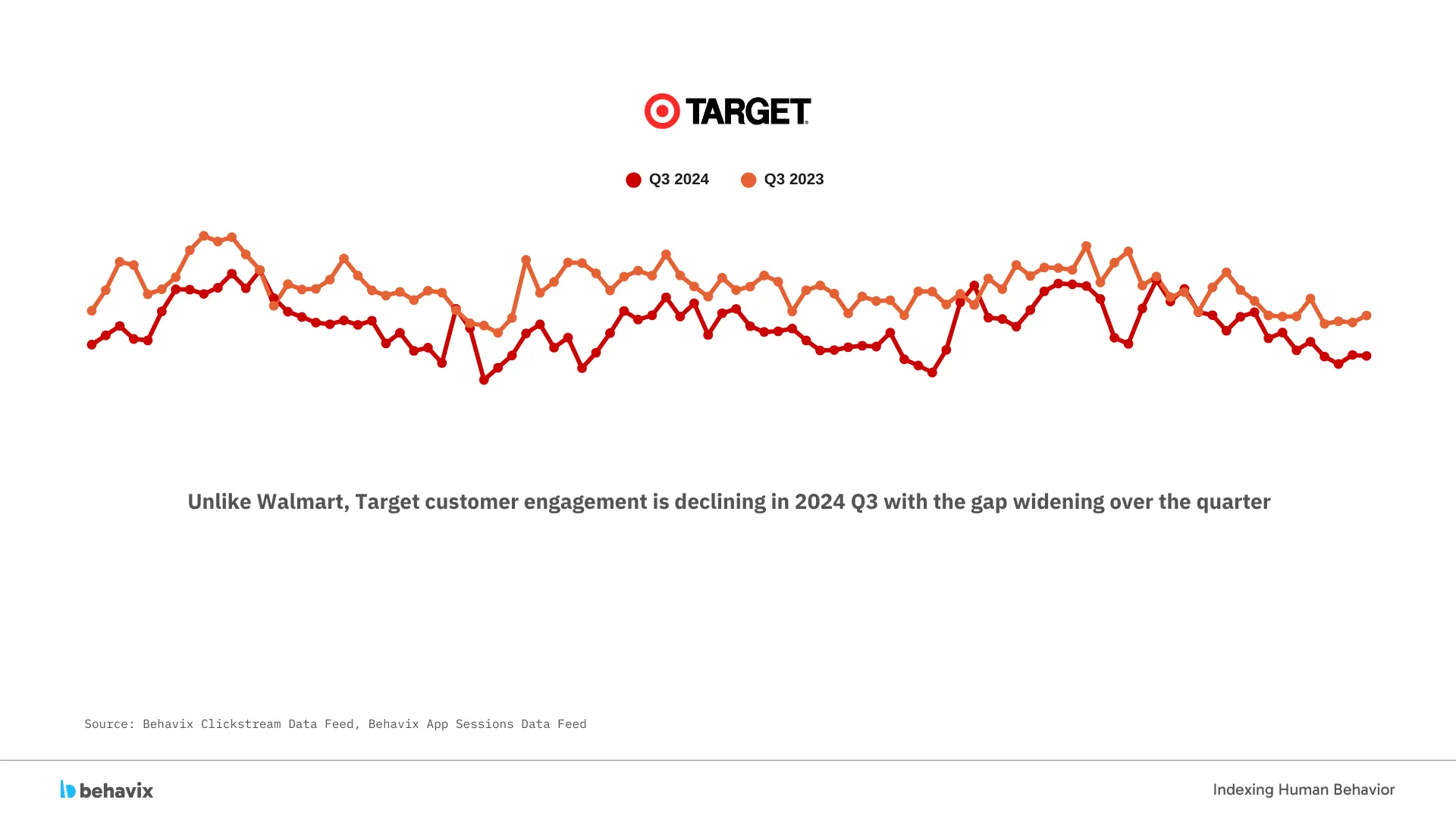

Next, we turn our attention to Target and conduct a similar YoY analysis of online customer engagement for Q3 2024 compared to Q3 2023. Unlike Walmart, the data reveals a noticeable decline in customer visits and interactions on Target’s digital platforms throughout the quarter. This downward trend remains consistent, indicating that lower engagement is not a short-term fluctuation but a broader shift in consumer behavior.

This comparative analysis highlights a crucial insight: discretionary spending among US consumers appears to be weakening. Unlike Walmart, which offers a broad mix of essential and budget-friendly items, Target is known for carrying a more upscale product assortment, including higher-end apparel, home goods, and electronics. With inflationary pressures persisting and household budgets tightening, consumers are likely prioritizing essential purchases over discretionary spending, leading to reduced engagement on Target’s platform relative to the previous year.

By leveraging real-time behavioral data, we can further analyze specific categories where demand has softened, identifying whether consumers are cutting back on luxury and non-essential items or shifting to alternative retailers. These insights offer valuable signals for investors, analysts, and retailers seeking to understand evolving consumer priorities and the broader economic impact on the retail sector.

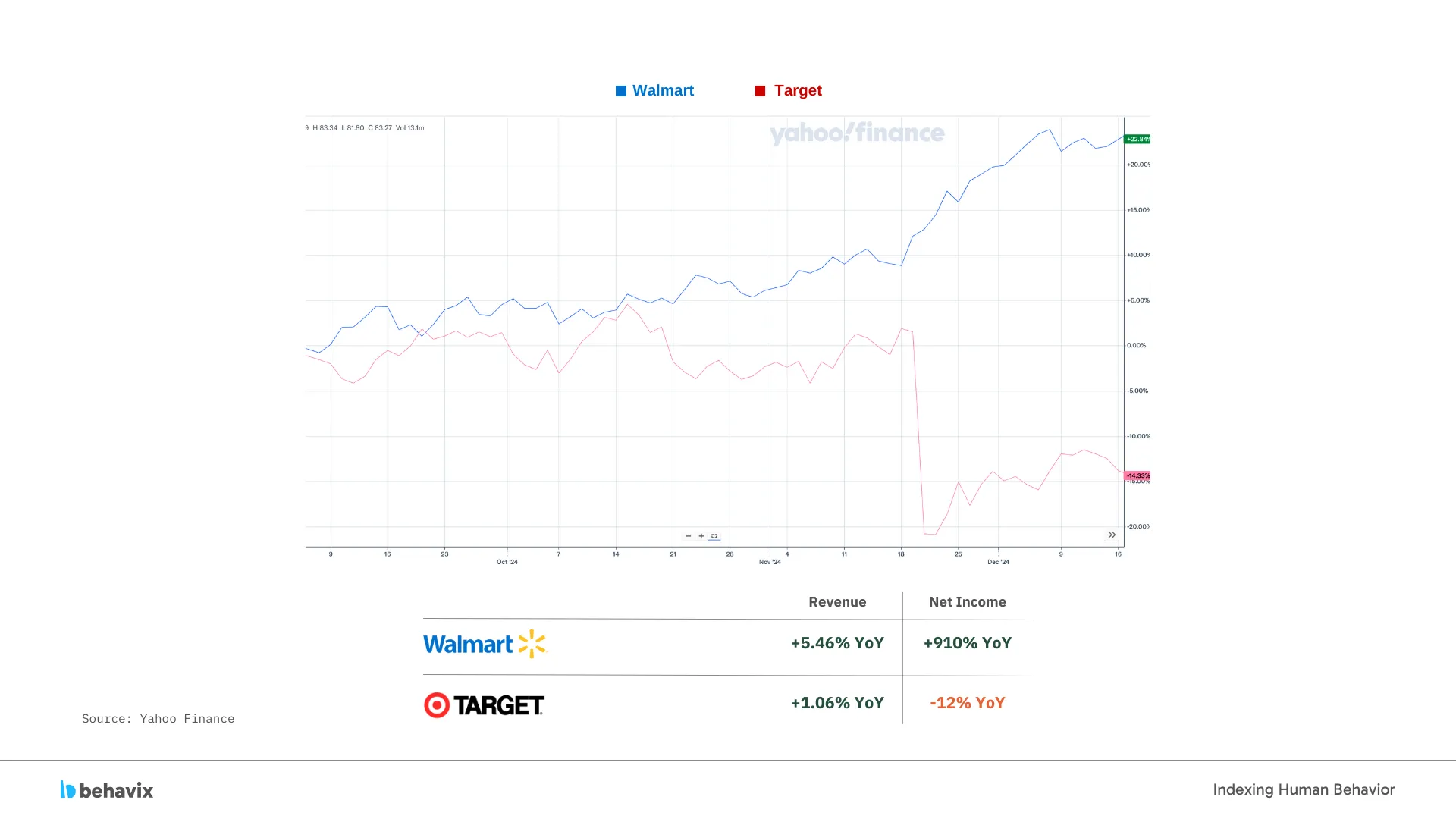

While our analysis focuses specifically on the US market and online retail channels, the insights gained are highly actionable from an investment standpoint. The United States remains the core market for both Walmart and Target, and e-commerce has become an increasingly significant component of their retail operations, especially following the surge in online shopping during and post the pandemic.

Although earnings reports capture global revenue and net income, US online sales serve as a key performance indicator that can provide early signals about overall company performance. A strong or weak digital engagement trend in the US can often foreshadow broader financial outcomes, making it a valuable metric for investors assessing potential stock movements.

This dynamic played out in the most recent earnings cycle. Walmart, which experienced higher digital engagement, reported stronger revenue and net income growth, leading to a positive stock price reaction. Conversely, Target, which saw a decline in online customer activity, adjusted its forward-looking guidance downward, signaling concerns about future performance. As a result, Target’s stock price fell on the day of its earnings call.

By leveraging real-time behavioral data, investors can anticipate these market shifts before they are reflected in earnings reports, positioning themselves strategically based on evolving consumer spending patterns.

Behavix Datafeed customers could have uncovered the widening gap between Walmart and Target as early as October 10—just seven business days after the quarter closed—giving them a full month’s head start before the earnings call. With real-time access to consumer behavior trends, investors, analysts, and researchers can move ahead of the curve, identifying predictive signals before they surface in traditional financial reports.

Behavix transforms passively collected behavioral data into actionable intelligence, helping hedge funds and market professionals decode shifting consumer patterns with precision. Don’t wait for earnings reports—leverage real-time behavioral insights to make informed, strategic decisions ahead of the market.

To learn more about how Behavix can help your business reach out to sales@behavix.io.

Strategic Data Advisor