Published

- 4 min read

Behind the Binge: What Behavix’s Real-Time Behavioral Clickstream Data Reveals About Netflix's Momentum

In the ever-evolving landscape of digital streaming, Netflix has long reigned as the dominant force — its global subscriber base soaring past 280 million by late 2024. But as the dust settles from the so-called “streaming wars,” a new phase begins — one marked not by victory, but by volatility. Audiences are shifting, habits are changing, and what worked yesterday may no longer hold today. There are remarkable deep-pocketed rivals like Amazon Prime and Disney+, not to talk about Apple TV+, but also many other smaller, fast-grown, or more niche streaming services. All these have the potential to eat into the Netflix subscriber base, and/or compete for engagement/market share.

In this climate of uncertainty, having early - or real-time - insight into behavioral trends is more valuable than ever, for example if you are about to trade on the stocks of these big companies. Behavix’s Data-as-a-Service platform equips investors with just that — real-time signals pulled from the digital footprints of over 500,000 U.S. users across mobile and desktop devices. This analysis zeroes in on Netflix’s mobile engagement data, revealing deeper clues about the company’s momentum — before earnings reports make the headlines.

Behavix continuously collects and analyzes customer engagement data from desktop (Windows, macOS, and Linux) and mobile (iOS and Android) devices. For this analysis, we’re focusing on mobile data — Statista ranks it as the second most popular device for content consumption after TVs. Rather than predicting total user numbers, this analysis aims to detect momentum—specifically whether Netflix is gaining or losing traction — using trend analysis across time series data.

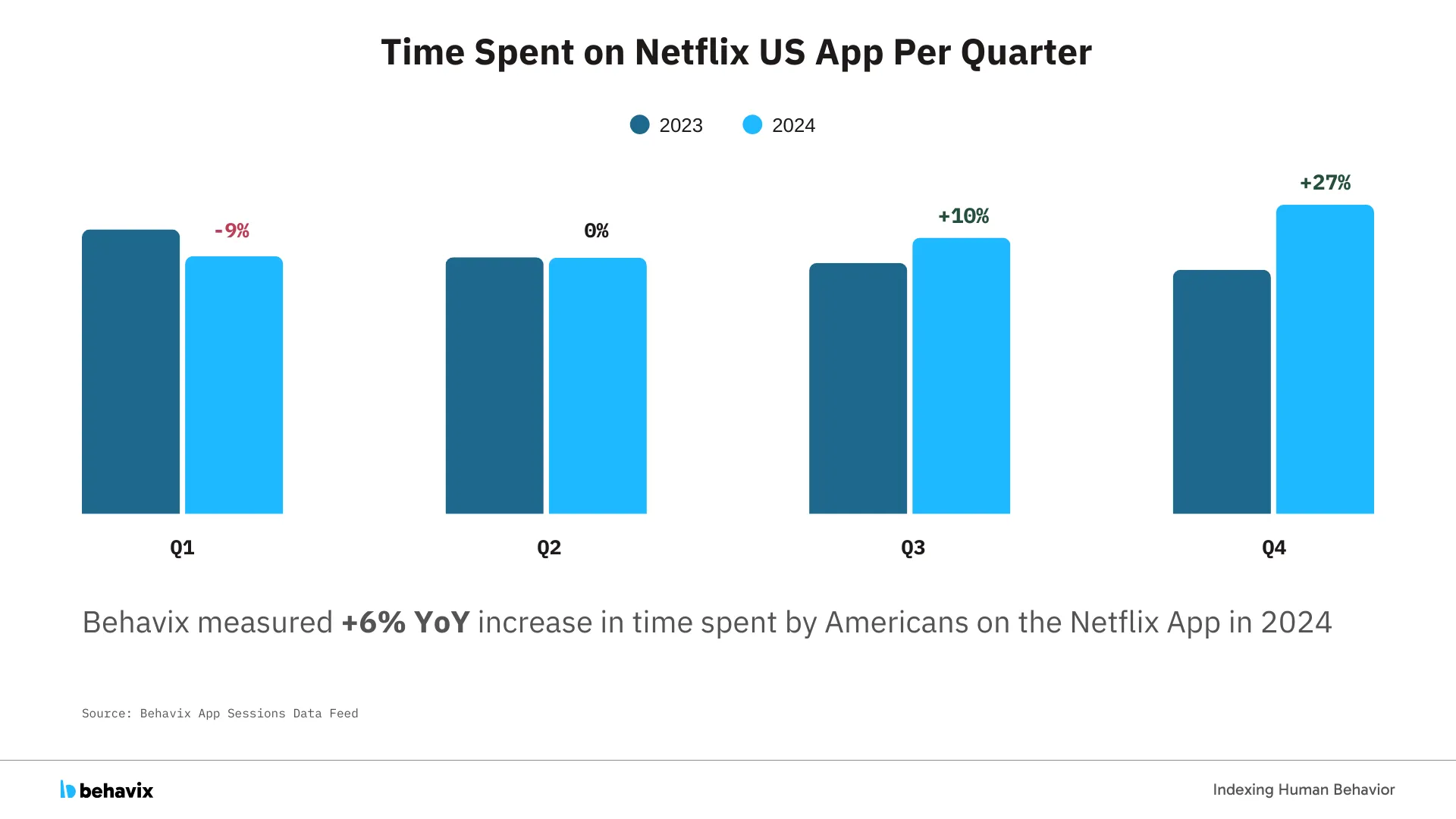

Using Behavix’s proprietary mobile app dataset, we measured time spent watching Netflix by U.S. users and examined quarter-over-quarter trends from 2023 through 2024. Engagement declined in Q1, remained flat in Q2, and saw growth in Q3 accelerating even further in Q4.

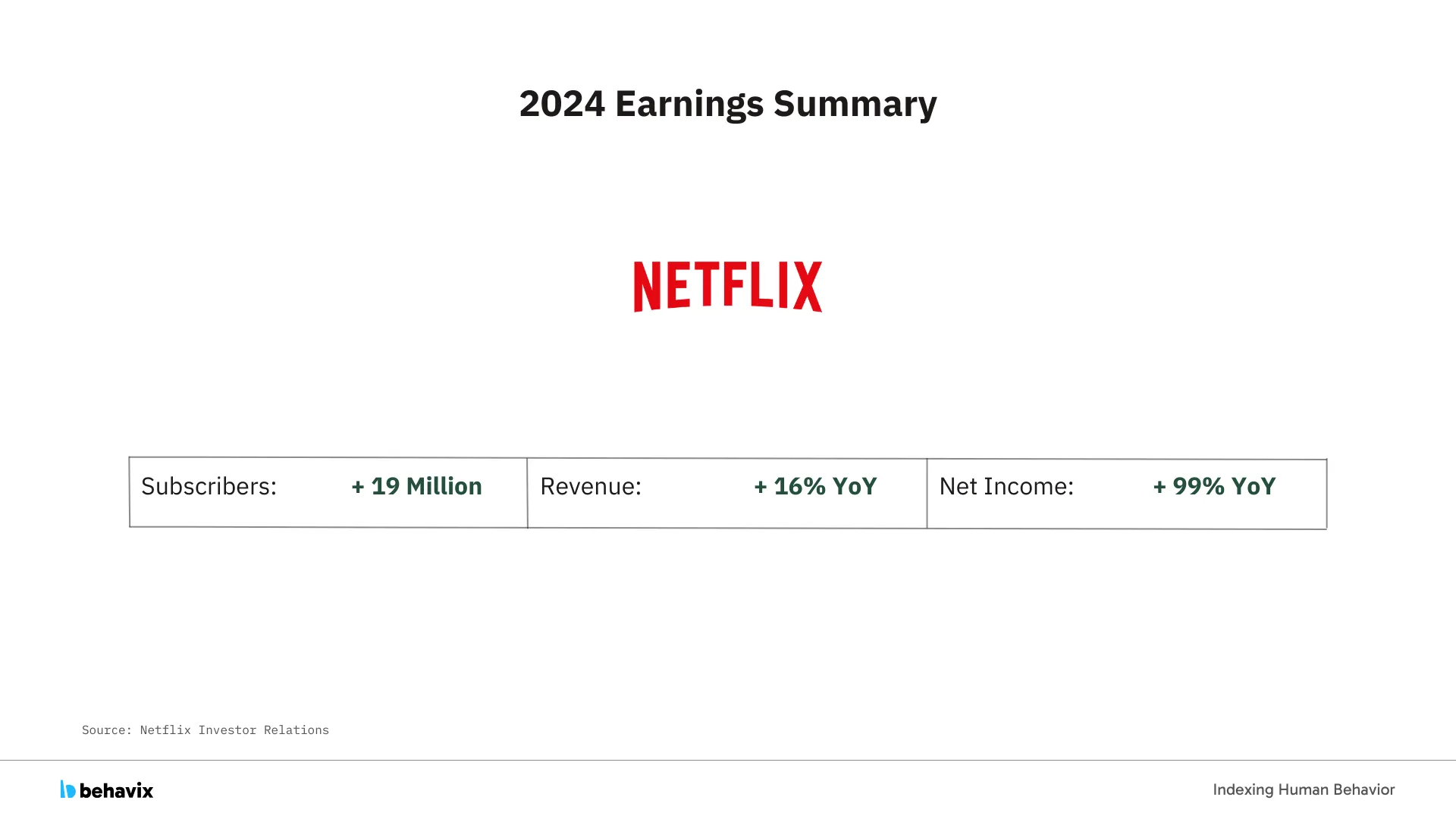

When compared to Netflix’s Q4 earnings report, we see a compelling correlation: subscriber counts rose 19 Million year-over-year, driving increases in both revenue and net income. Although our data is U.S. only and mobile-specific, this pattern may serve as a bellwether for global subscriber trends and earnings impact.

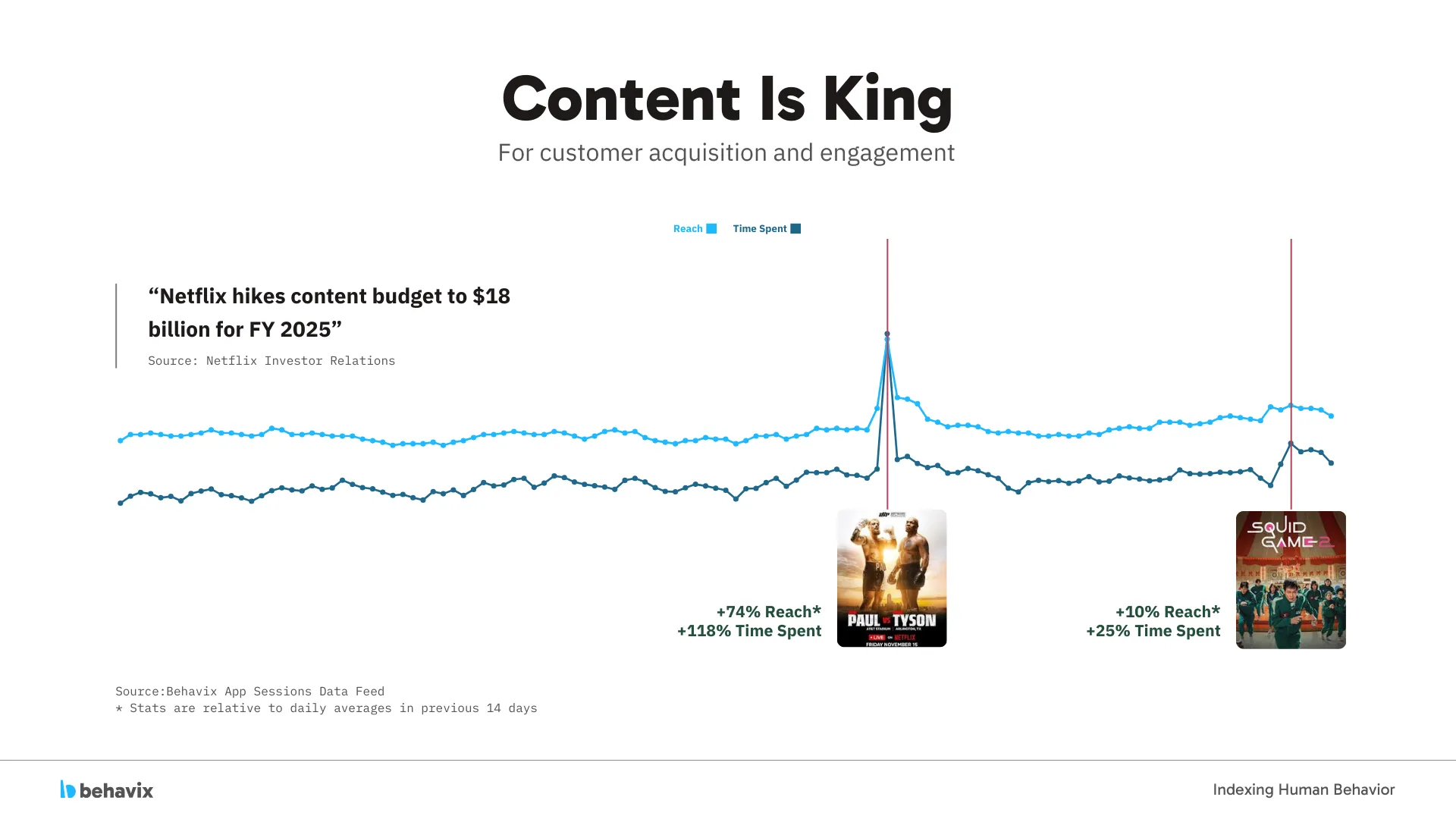

Since Q4 showed the strongest growth in engagement, we took a closer look at this quarter to uncover possible catalysts.

Charting daily reach (unique users) and time spent reveals two standout events:

-

Nov 15: The livestreamed Paul vs. Tyson’s event triggered a 74% increase in users and a 118% spike in time spent on that day alone, compared to the prior two weeks.

-

Dec 26: The launch of Squid Game Season 2 resulted in a 10% increase in users and a 25% increase in time spent on that day alone, compared to the prior two weeks

Both events had residual effects in the days that followed, as shown in the accompanying visualization. This reinforces the industry maxim: “Content is King.” Netflix’s decision to raise its content budget to $18 billion for 2025 likely reflects its internal data confirming that blockbuster content boosts engagement—and by extension, subscriber growth and investor confidence.

Behavix’s real-time behavioral data empowers investors and researchers to not only detect market shifts early—but to understand the “why” behind them.

This analysis, based on data as of January 10, demonstrates not just that Netflix saw YoY engagement growth, but also why it happened: through strategic content launches. As Netflix doubles down on premium content in 2025, these insights become even more valuable.

Behavix delivers real-time, ground-truth behavioral data that captures how consumers actually engage with streaming platforms—what they watch, when, and for how long—across mobile and desktop devices. Unlike modeled estimates or lagging surveys, our passively collected data reveals actionable momentum signals ahead of earnings, enabling hedge funds to anticipate subscriber trends, content performance, and platform shifts with daily granularity. For the alternative data industry, Behavix is an essential edge—offering structured, high-frequency insights that power alpha-generating models and unlock a deeper understanding of digital consumer behavior.

To learn more about how Behavix can help your business reach out to: sales@behavix.io.

Strategic Data Advisor